Buy a Car After Bankruptcy In Ontario With 4 Simple Steps

Buy a Car After Bankruptcy In Ontario With 4 Simple Steps

Posted on February 9, 2024

There are some things you must be aware of when trying to buy a car after bankruptcy in Ontario. The good news is that your sacrifices during the bankruptcy will give you a new financial lease on life, but there are some unique challenges that you must overcome, as our auto loans team explains.

How Long Ago Were You Discharged From Bankruptcy?

Your bankruptcy trustee would have given you a document. This is your official discharge from bankruptcy, and if you don't have it, you can't take on any new debts.

If you don't have this document, you should talk to your trustee about when you can get it.

Starting All Over

During your bankruptcy, all of your creditors would have written off your debt; while this erased your legal obligation to repay the creditors, the actual bankruptcy will stay on your credit report for up to seven years.

There is a good chance your credit score is in the 400s or even lower because there has been no positive activity since your bankruptcy trustee declared you insolvent.

You must start rebuilding your credit by signing up for a secured credit card from Capital One or Home Trust.

These secured credit cards are not the same as prepaid cards; when you use the secured cards, you will receive an invoice every month that needs to be paid by the due date.

So long as you make your payments on time, your credit score will start to improve. This is the first step to rebuilding your credit, which takes time, but it will be worth it in the long run.

Having the Right Mix of Credit Products

Secured credit cards are a great first step when rebuilding your credit, but credit cards are just one type of credit product.

You also need to add instalment loans to the mix so your credit score can bounce back quickly.

No lender will give you a loan that falls under the installment loan category, but there are services like the Koho credit building program that will report an installment loan to TransUnion for $7 per month for six months; if you miss any payments, it will be as if you miss a real payment and it will hurt your credit.

Keep Credit Use to a Minimum

Aside from the credit card, try to avoid borrowing anything while you’re building credit and especially when preparing for a car loan.

We want you to keep credit utilization low so keep an eye on spending and make sure you don’t start getting into debt again.

Budgeting For Your New Car

Everyone who has gone bankrupt must attend classes on budgeting; you would have learned how to create a budget.

Since you do not have any credit-related debts, there should be a significant portion of your take-home pay available for discretionary spending like making a car payment.

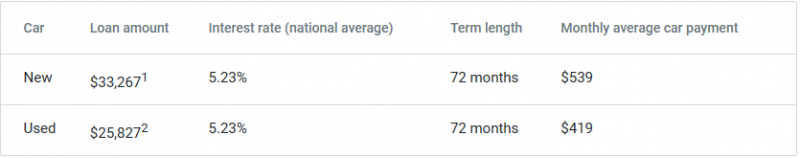

You will need to set aside at least five hundred dollars per month which is the average car payment in Canada.

Along with the amount for your car payment, you must factor in the cost of gas, insurance, and other operating costs that come with owning a car.

You may feel overwhelmed, but this is a major step toward rebuilding your life.

Having the Correct Car-Buying Expectations

The average price of a new car is over forty thousand dollars, and since your credit score is low, most lenders will not issue a loan.

Your best option when buying a car after bankruptcy is to get a used car; there are many excellent used cars out there in the market, so you have plenty of great options available.

Save For a Down Payment

The larger the down payment you can put down, the more likely you are to be accepted for a car loan.

Down payments insulate the lender from loss as they know they can repossess and sell the car if you default. If any potential depreciation or loss is covered by your down payment, their risk is lower, so they are more likely to agree on the loan.

Where to Buy a Car After Bankruptcy

Most mainstream lenders are not willing to deal with borrowers who just got out of bankruptcy; there are options available.

Your best option is to go through a dealership in your area that has extensive knowledge of working with borrowers just like you.

Once the dealership has discussed your unique situation and has a clearer picture, they will be able to pick a lender that is best suited for you.

Remember, the dealership and lender all want to give you a car loan; they just need to make sure you meet the underwriting criteria.

The dealership will also give you valuable advice on what steps you can take to rebuild your credit score. By going through the dealership channel, you are going to have an amazing experience so contact the dealership today.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.