Buying a Car When Self Employed: The Short Road To Approval

Buying a Car When Self Employed: The Short Road To Approval

Posted on August 7, 2023

Purchasing a car when you're self-employed in Canada can be both exciting and challenging. As a self-employed individual, you have unique financial circumstances that may differ from traditional employees, affecting your ability to secure financing.

In this article, we'll explore various aspects of buying a car when self-employed in Canada, providing valuable insights and tips to make the process smoother.

Establishing Income Proof

When you're self-employed, providing income proof becomes crucial in the car-buying process. Unlike traditional employees who receive regular pay stubs, you may not have the same documentation. However, you can still demonstrate your income stability through alternative methods such as:

Financial Statements: Prepare your business financial statements, including income statements, profit and loss statements, and balance sheets, ideally for the past two to three years.

Tax Returns: Provide your personal tax returns along with your business tax returns, as they can serve as strong indicators of your income history.

Bank Statements: Furnish your bank statements to showcase consistent cash flow and revenue deposits.

Building a Strong Credit Profile

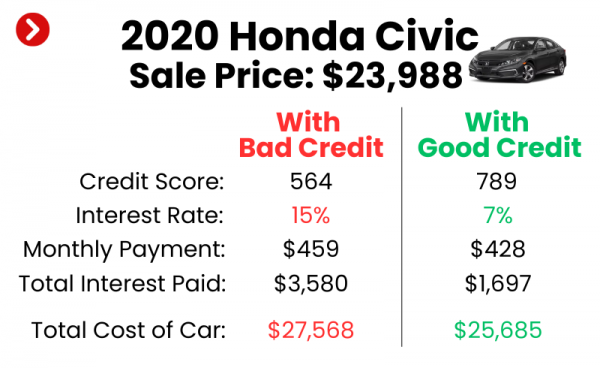

Having a strong credit profile is generally beneficial when purchasing a car. Lenders often evaluate credit history to assess the risk associated with providing a loan.

As a self-employed individual, maintaining a good credit score can increase your chances of obtaining favorable financing terms.

3. Saving for a Down Payment

Regardless of your employment status, a down payment can significantly impact your car-buying journey. By saving a substantial down payment, you can reduce the amount you need to finance, leading to lower monthly payments and a potentially lower interest rate.

4. Determining Your Budget

Before car shopping, it's crucial to establish a realistic budget that considers both the purchase price and ongoing expenses. As a self-employed individual, your income might fluctuate, so it's prudent to set a budget that you can comfortably manage during leaner months.

5. Researching Suitable Cars

Conduct thorough research on various car models that suit your needs and budget. Consider factors like fuel efficiency, maintenance costs, insurance rates, and overall reliability.

As a self-employed individual, you'll want a vehicle that aligns with your business requirements while offering comfort and convenience.

6. Consider Business Usage

If you plan to use the car for business purposes, it's essential to understand how this affects your tax deductions.

In Canada, self-employed individuals can claim certain vehicle expenses as business deductions, such as fuel, maintenance, and lease payments, but it's crucial to keep meticulous records to substantiate these claims.

7. Exploring Lease Options

Leasing a car can be a viable option for self-employed individuals, as it often requires a lower down payment and offers the opportunity to drive a newer vehicle with lower monthly payments. However, carefully review the lease terms, mileage restrictions, and potential end-of-lease charges.

If you need help deciding whether to lease or finance your next car. click here.

You're Ready to Get Approved!

Buying a car when self-employed in Canada involves unique considerations, particularly regarding income proof and credit history.

By gathering the right documentation and maintaining a strong financial profile, you can improve your chances of securing favorable financing terms.

Additionally, setting a realistic budget, researching suitable cars, and exploring leasing options can help you make an informed decision that aligns with your business and personal needs.

Always seek advice from a financial professional or tax advisor to ensure you navigate the process effectively and make the best choice for your specific situation.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval