Can I Buy a Car With No Credit History in Canada?

Can I Buy a Car With No Credit History in Canada?

Posted on April 16, 2024

Picture this: you've finally landed that dream job, and now you're ready to take the next step toward independence by purchasing your very own car. But there's a tiny roadblock: you have no credit score.

While it might seem like a daunting challenge, fear not! We're here to guide you through the process of buying a car with no credit score.

1. Understanding the Importance of Credit Scores

Before we dive into the details, let's quickly grasp the significance of credit scores.

In Canada, credit scores are a vital component of financial health, as they reflect an individual's creditworthiness.

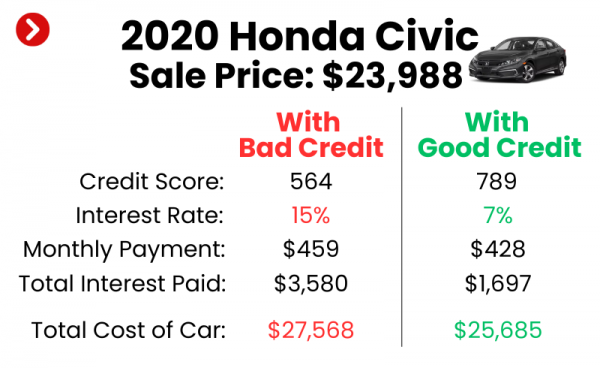

Lenders use credit scores to assess the risk associated with extending credit, including car loans.

However, if you have no credit score, don't fret. There are alternative routes to explore.

2. Saving for a Down Payment

When you have no credit history, having a substantial down payment can work wonders in gaining approval for a car loan.

Lenders often view a larger down payment as a commitment from the buyer and a reduced risk for themselves.

Start setting aside funds early on, and aim for a down payment of at least 20% of the vehicle's purchase price.

3. Exploring Co-Signer Options

If you're unable to obtain a car loan on your own, consider finding a trusted friend or family member who is willing to co-sign the loan with you.

A co-signer essentially guarantees repayment if you default on the loan.

Remember, this is a significant responsibility, so make sure your co-signer understands the implications and is financially capable of taking on this role.

4. Exploring Alternative Financing Options

Traditional lenders may not be your only option.

Explore alternative financing options such as specialized car loan providers, dealerships that offer in-house financing, or credit unions that have flexible lending criteria.

These institutions may be more open to working with individuals who have no credit score.

5. Researching Car Dealerships

Not all car dealerships are created equal. Look for dealerships that specialize in working with individuals with no credit score or limited credit history, like us!

They are experienced in navigating unique financing situations and can provide valuable guidance throughout the process.

6. Consider a Used Car

While it's tempting to go for that shiny new car, consider purchasing a used vehicle as your first car.

Used cars generally have a lower purchase price, which means a smaller loan amount.

This can increase your chances of getting approved for a loan, even without a credit score.

Plus, buying a reliable used car allows you to build credit for future purchases.

7. Patience and Persistence

Remember, buying a car with no credit score may require patience and persistence.

It's essential to stay positive and keep exploring different options.

Continue to improve your financial habits, such as paying bills on time, keeping your credit utilization low, and gradually building credit.

These efforts will lay a strong foundation for future financing opportunities.

8. Utilize Car Loan Calculators

Before finalizing any deal, utilize online car loan calculators to get an estimate of the loan terms, interest rates, and monthly payments you can expect.

This information will help you plan your budget and make an informed decision.

9. Seek Professional Advice

When in doubt, seek professional advice.

Speak to a financial advisor or credit counselor who can provide personalized guidance tailored to your specific circumstances.

They can help you understand the intricacies of the car-buying process and assist you in making sound financial choices.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Ontario Car Loan Pre-Approval