Can You Get a Loan For a Used Car in Canada?

Can You Get a Loan For a Used Car in Canada?

Posted on August 21, 2023

The Answer Is... Yes!

Yes, you absolutely can get a car loan for a used car. Just like new cars, used cars can also be financed through loans.

In fact, many financial institutions offer loans specifically tailored for used cars. These loans work similarly to loans for new cars but come with a few differences.

Loan Terms May Vary

The terms of a used car loan might differ from those of a loan for a new car. Used car loans could have slightly higher interest rates, as the perceived risk for lenders might be slightly elevated for older vehicles.

The loan term could also be influenced by the age of the used car, typically ranging from 24 to 72 months.

Down Payments and Loan Amounts

When securing a loan for a used car, you might find that lenders require a larger down payment compared to loans for new cars. This helps offset the potential risk associated with older vehicles.

The loan amount you can get approved for depends on various factors, including your credit score, income, and the value of the used car. By the way, zero down payment car financing is also an option if you don't have time to save. Click here to learn more about that.

Vehicle Inspection and Appraisal

Lenders often require a thorough inspection and appraisal of the used car before finalizing the loan. This is to ensure that the vehicle's condition matches its value and that there are no underlying issues that might affect its longevity.

The appraisal process helps determine the maximum loan amount the lender is willing to provide.

Interest Rates

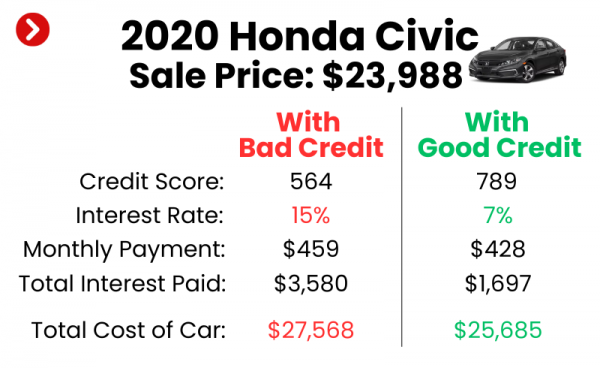

Interest rates for used car loans can vary based on your credit score and the lender's policies. While they might be slightly higher than rates for new cars, it's essential to shop around for the best deal.

A higher credit score could still help you secure a competitive interest rate for your used car loan.

Loan Approval Process

The approval process for a used car loan is similar to that of a new car loan. Lenders will evaluate your creditworthiness, income stability, and debt-to-income ratio.

A good credit history increases your chances of approval and might even lead to more favorable terms.

Consider the Car's Age and Mileage

Keep in mind that the age and mileage of the used car could impact your loan options. Some lenders might have restrictions on financing cars over a certain age or with exceptionally high mileage.

It's advisable to inquire about these restrictions before settling on a specific used car.

Final Thoughts

So, the next time you're browsing through a selection of pre-owned vehicles and wondering if you can get a car loan for a used car, remember that the answer is a resounding yes.

With the right financial planning, a decent credit score, and an understanding of the loan terms, you'll be cruising in your chosen used car in no time!

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.