8 Car Financing Tips That'll Make Your Experience Way Easier

8 Car Financing Tips That'll Make Your Experience Way Easier

Posted on April 19, 2024

Looking to buy a car in Canada? Finding the right financing options can be daunting. In this article, we will provide you with essential tips to help you secure affordable car financing without overwhelming you with complex jargon. Get ready to hit the road with confidence!

1. Determine Your Budget and Stick to It

Before embarking on your car financing journey, set a realistic budget that includes not only the car price but also insurance, maintenance, and fuel costs.

Knowing your financial boundaries will help you narrow down your options and prevent you from overextending yourself.

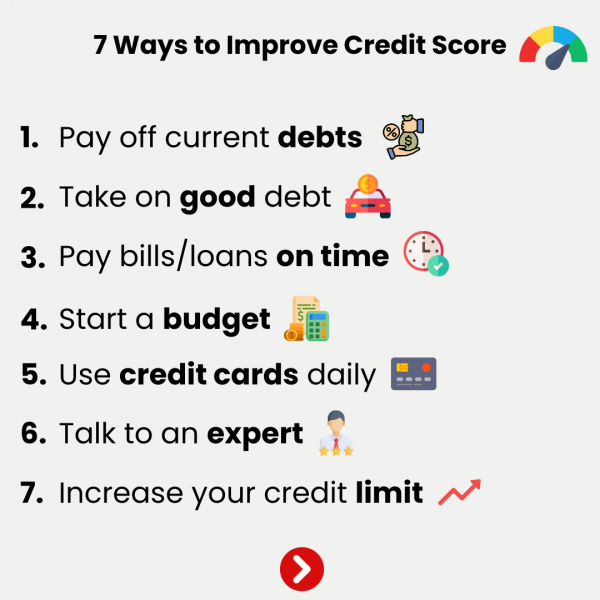

2. Boost Your Credit Score

Maintaining a healthy credit score can significantly impact the financing terms you receive. Ensure you pay your bills on time, reduce credit card balances, and avoid unnecessary debt.

Regularly checking your credit report will allow you to identify any errors and rectify them promptly, ensuring a better chance at securing favorable financing rates.

3. Save for a Down Payment

Saving for a down payment is a smart move when financing a car. A larger down payment will lower your loan amount, which means lower monthly payments and potentially better interest rates.

Aim to save at least 10-20% of the car's purchase price as a down payment to maximize your savings in the long run.

4. Research Different Lenders

Explore various financing options beyond traditional credit unions and banks. Online financial institutions, specialized car financing companies, and even dealerships often provide competitive rates.

Research the reputation and terms of multiple lenders to find the one that suits your needs and offers the best interest rates.

5. Get Pre-Approved for Financing

Before visiting dealerships, get pre-approved for a car loan. This will give you a clear idea of your borrowing capacity and the interest rates you can expect.

Pre-approval also provides leverage when negotiating with dealers, as you already have a confirmed financing offer in hand.

6. Consider Financing Term Length

While longer loan terms may result in lower monthly payments, they often come with higher interest rates and more interest paid over time.

Aim for the shortest term you can comfortably afford to minimize the overall cost of your car. Strike a balance between affordable monthly payments and a reasonable repayment period.

7. Don't Forget About Insurance

Auto insurance is a legal requirement in Canada, and the cost can vary significantly based on the car you drive. Research insurance premiums for different car models and choose wisely to ensure your insurance fits within your budget.

Additionally, maintaining a clean driving record can help you secure lower insurance rates.

8. Negotiate the Purchase Price

When buying a car, negotiation skills can be your best friend. Research the market value of the car you desire and be prepared to haggle with the dealership or private seller. A lower purchase price means a smaller loan amount, reducing your overall financial burden.

Securing affordable car financing in Canada doesn't have to be an overwhelming process. By setting a budget, improving your credit score, saving for a down payment, and exploring multiple lenders, you can find favorable terms that fit your needs. Remember to negotiate and choose insurance wisely to make the most of your car ownership experience. Hit the road with confidence and enjoy your new wheels!

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.