Car Loan After a Consumer Proposal: Get Qualifed For Financing

Car Loan After a Consumer Proposal: Get Qualifed For Financing

Posted on January 16, 2024

Securing auto financing after a consumer proposal can be a challenging. Usually because of the bruise it can leave on your credit score. However, it's still possible, and with careful planning and informed decision-making, not only will you be able to finance a vehicle, you'll be able to finance one that meets your wants and needs.

This article covers everything you'll need to know when financing a car loan after a consumer proposal in Canada. We hope this empowers you with the knowledge needed to make intelligent financial decisions, improve your credit score (and overall financial standing), and finance a car you love. Let's do it!

1. Rebuild Your Credit

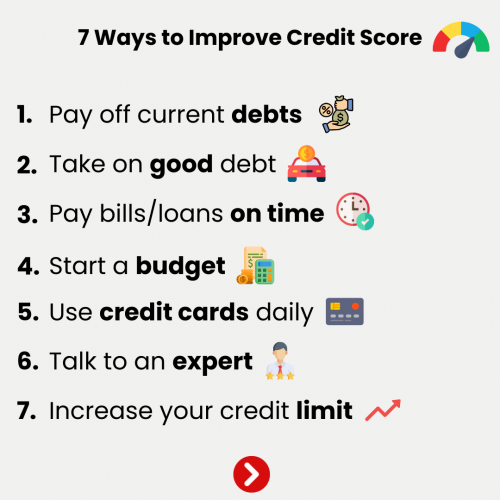

The first and most crucial step towards getting a car loan after a consumer proposal is to focus on rebuilding your credit score. Unfortunately this usually takes months and can take up to a year. Sometimes people need a car right after their consumer proposal. That's what bad credit car loans are for. Learn all about them here.

A consumer proposal remains on your credit report for three years after completion. During this time, it's essential to demonstrate responsible credit behaviour to improve your creditworthiness. Make sure to pay all your bills and existing credit obligations on time and in full.

You may also consider obtaining a secured credit card or small loan to show responsible credit utilization.

By the way, a car loan is by far the best way (aside from a mortgage) to increase your credit score!

2. Save for a Down Payment

Lenders may be hesitant to approve car loans for individuals who have recently completed a consumer proposal.

To increase your chances of approval, save up for a substantial down payment. A sizeable down payment demonstrates your commitment to the purchase and reduces the risk for the lender. It decreased the amount you'll need to take a loan for, and shortens the amount of time you'll be paying it off.

We usually recommend saving at least 20% of the car's purchase price, however, a down payment isn't always necessary depending on where you finance the vehicle. We offer $0 down car financing.

3. Find a Co-Signer (if Possible)

Having a co-signer with a strong credit history can significantly improve your chances of obtaining a car loan. It can also help improve your credit!

The co-signer takes joint responsibility for the loan and pledges to repay the debt if you default.

This added security reassures the lender and may lead to more favourable loan terms and interest rates. If you're not sure whether you need a co-signer, click here to learn more.

4. Choose a Sensible Car

Opt for a car that fits within your budget and aligns with your financial situation. Avoid high-priced luxury vehicles and focus on practical and affordable options.

Lenders may be more willing to approve loans for modest cars that are easier to repay. Here's a link to some great reliable used vehicle options

5. Find a Dealer that Finances Post-Consumer Proposal Car Loans

Some dealerships in Canada specialize in providing financing solutions for individuals who have recently completed a consumer proposal (like us!).

These dealerships understand the unique challenges borrowers face and are more willing to work with them. Research and reach out to such dealerships to discuss your financing options.

6. Provide Proof of Stable Income

Lenders are more likely to approve car loans if you can demonstrate a stable income. Prepare documents such as recent pay stubs, employment verification letters, or tax returns to showcase your financial stability. Consistent income reassures lenders that you can meet your loan obligations.

Acceptable Proofs of Income

- Pay Stubs/Wage Slips: Recent pay stubs providing a snapshot of your income over the last few months.

- Employment Verification Letter: A letter from your employer confirming job details and income, particularly useful for those without traditional pay stubs.

- Notice of Assessment (NOA): Personal or business tax returns, often required with additional forms like T4, T4A, or T5.

- Bank Statements: Recent bank statements showing regular deposits and offering a broader financial overview.

- Proof of Additional Income: Documentation for other income sources like rental income, dividends, or alimony.

- Letter of Award or Benefits Statement: For those receiving government benefits or grants, an official letter or statement serves as proof.

- Pension Statements: If retired and receiving a pension, providing pension statements as proof of income.

- Business Financial Statements: For business owners, financial statements for the business may be required.

7. Get Pre-Approved

Before visiting a dealership, get pre-approved online. Pre-approval gives you a clear understanding of the loan amount and interest rate you qualify for. You can apply for pre-approval from local dealerships, specialized auto finance companies, and banks.

Getting pre-approved makes buying a car after a consumer proposal so much easier, making it more efficient and convenient. For example, if you get pre-approved with us, you're basically buying the car completely online. We'll send you your loan term options, send us the needed paperwork, and come pick up the car when everything is decided!

You're Ready to Buy a Car After a Consumer Proposal

Acquiring a car loan after completing a consumer proposal in Canada may seem daunting, but it is possible with proper planning and understanding of the process.

Demonstrating financial responsibility and stability will increase your chances of obtaining a car loan with favorable terms.

Remember, each borrower's situation is unique, so it's essential to explore options that suit your specific needs and financial capacity.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval