Car Loans For Uber Drivers: Make Money With a Car You Finance

Car Loans For Uber Drivers: Make Money With a Car You Finance

Posted on March 21, 2024

Whatever your opinion of ride sharing apps, they have changed the way people travel and earn money. For travellers, they are a convenient way to get around. For drivers, ride sharing apps provide a flexible way to earn a living.

If you want to become an Uber driver but don’t yet have a car, can you get a loan for one?

Yes you can!

Car Loans for Uber drivers

Uber runs their own finance arm that can provide the cash you need to buy a car. We don’t know much about the company’s offerings or whether it makes financial sense or not.

What we would say is that it might not be such a good idea to tie yourself so closely to one company. Especially a company that doesn’t regard its workers as employees.

We would recommend using your own car loan to finance a car for Uber. That way you have independent finance and have more control over your own destiny.

Should you want to switch to driving for another ride sharing firm, you would be free to do so. If you wanted to take a break from Uber, you could. All without impacting your car loan.

So with that in mind, you’ll need to:

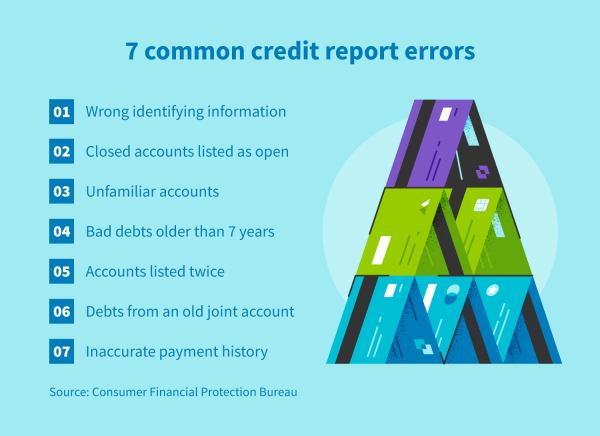

Access Your Credit Report

Check your credit score, check your history for mistakes and omissions, and make sure everything on your credit report is accurate. Then you have a firm base from which to build your loan application. Click here to learn how to check your credit score.

Research Your Car of Choice

Uber has different car classifications such as Comfort, Green, Exec, XL and so on. Each requires a certain type of car.

Knowing what types of ride are more in demand in your area and what would be affordable is your next task.

There’s no point buying something for Exec if most of the rides in your area are Green. The same for Comfort when most people in your area want XL.

Find out what the most popular ride types are and how much competition there is from other drivers.

Then make a decision about which segment you’re going to work in and what budget you’ll need.

Set Your Budget

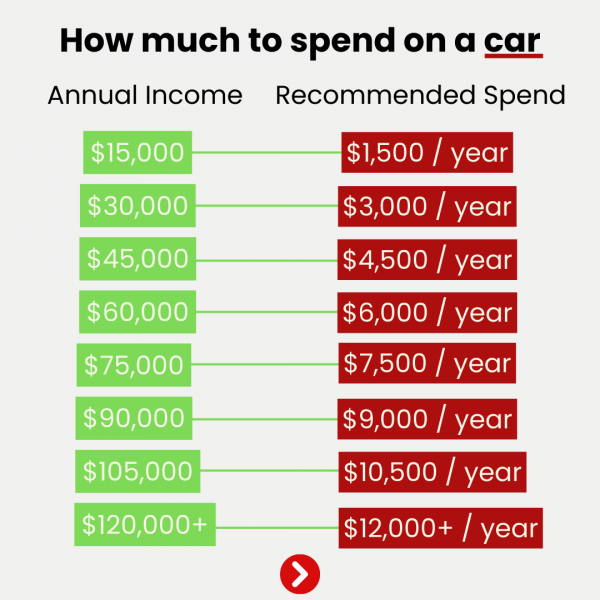

A budget for a new car should satisfy all your needs and ideally a few of your wants too. Knowing the ride types you want to go for, you can set a realistic budget to buy the type of car suitable.

Once you have a realistic budget, stick to it! Click here to learn how much you should spend on your next car.

Secure Your Loan & Buy the Car

Now you know what to buy and how much you’ll need to buy it, it’s time to go for it. Put together your down payment or prepare your trade in, find the right car in one of our dealerships and secure the car loan.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.