Car Loans While On Employment Insurance (EI) In Canada

Car Loans While On Employment Insurance (EI) In Canada

Posted on April 8, 2024

For many Canadians, owning a car is essential for daily commuting, running errands, and maintaining a sense of independence.

However, obtaining a car loan while on Employment Insurance (EI) can be challenging, as lenders often consider it a risk due to the temporary nature of the benefit.

Despite the limitations of traditional lending options, there are alternative paths that individuals on EI can explore to finance their car purchases.

This article will delve into various strategies and considerations to secure a car loan while on EI in Canada.

Understanding Employment Insurance (EI)

Employment Insurance is a social security program in Canada that provides temporary financial assistance to eligible individuals who have lost their jobs through no fault of their own.

The benefits are designed to support these individuals while they actively seek new employment or undergo training.

Improving Eligibility for a Car Loan

While on EI, potential car buyers can enhance their eligibility for a car loan by considering the following factors:

Stable Employment History: Lenders may look more favorably upon applicants with a stable employment history before the job loss leading to EI.

Demonstrating consistent work records and previous positive credit history can strengthen the loan application.

Additional Sources of Income: If the applicant has additional sources of income besides EI, such as freelance work, part-time jobs, or rental income, it could positively impact their loan application.

Seek a Cosigner or Guarantor

One effective way to increase the likelihood of getting a car loan on EI is by finding a cosigner or guarantor.

A cosigner is a person with a stable income and a good credit score who agrees to take responsibility for the loan if the borrower defaults.

A guarantor, on the other hand, pledges to make payments if the primary borrower cannot.

Having a reliable cosigner or guarantor can alleviate the lender's concerns about the temporary nature of EI benefits.

Down Payment

A larger down payment can significantly influence the loan approval process.

Putting more money down upfront reduces the loan amount, which lowers the risk for the lender.

Saving up for a substantial down payment while on EI can improve the chances of obtaining a car loan.

Explore Dealerships with Special Programs

Some car dealerships may have special financing programs for individuals on EI or those with less-than-perfect credit.

Researching and connecting with dealerships that offer such programs can open up opportunities for obtaining a car loan.

Credit Score and Report

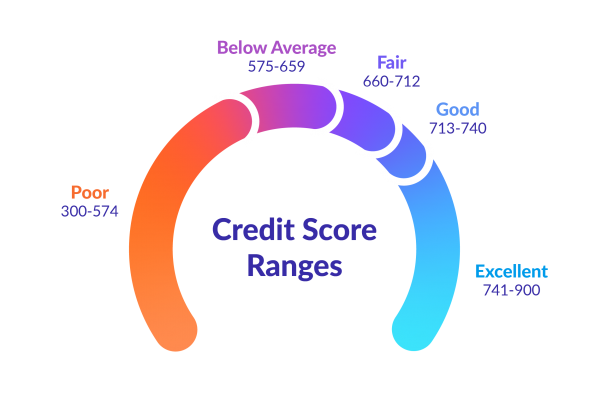

A good credit score can improve the chances of getting approved for a car loan.

It is advisable for individuals on EI to check their credit report for any errors or discrepancies that may negatively impact their application.

Can You Get a Car Loan On EI? It Really Depends

Securing a car loan while on Employment Insurance in Canada might be challenging due to the temporary nature of the benefit. However, it is not an impossible task.

By showcasing a stable employment history, exploring alternative sources of income, finding a cosigner or guarantor, and considering dealerships with special programs, individuals on EI can improve their chances of obtaining a car loan.

Additionally, saving up for a significant down payment can further boost their eligibility.

It is crucial to research different options, understand the terms and conditions thoroughly, and ensure that the monthly payments fit within the budget constraints while on EI.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Ontario Car Loan Pre-Approval