Getting a Car Loan With a New Job: 8 Tips You Need To Know

Getting a Car Loan With a New Job: 8 Tips You Need To Know

Posted on September 8, 2023

Have you ever wondered about the feasibility of obtaining a car loan with a new job? It's a situation many Canadians find themselves in – the need for a reliable vehicle coupled with the excitement of a new job opportunity. But can you secure a car loan under such circumstances?

The answer might surprise you. This article explains the intricacies of obtaining a car loan with a fresh job and explores the steps you can take to increase your chances of approval.

Understanding the Challenge

Securing a car loan with a new job might seem challenging due to the financial uncertainty associated with starting a new position.

Lenders typically favor stability and a consistent income source. However, there are strategies you can employ to address these concerns.

Showcasing Stability

One effective approach is to emphasize any prior job history and stability you possess. If you've recently switched jobs but have a solid employment record, showcasing this to potential lenders can work in your favor.

Highlighting your dedication and commitment to previous employers demonstrates reliability.

Demonstrating Financial Capability

While your new job may not have a long history, showcasing your financial capability is crucial. This involves providing comprehensive documentation of your income, including recent pay stubs, tax returns, and employment verification.

Such documentation assures lenders of your ability to meet monthly payments.

The Importance of a Down Payment

A substantial down payment can significantly improve your chances of obtaining a car loan, even with a new job. However, if you need a car loan right away and don't have time to save for a down payment, $0 down car financing is also an option.

Putting down a larger initial payment not only reduces the overall loan amount but also indicates your commitment to the investment. Lenders are more likely to view you as a responsible borrower.

Co-Signers and Guarantors

Enlisting the help of a co-signer or guarantor with a stable income and good credit history can enhance your chances of loan approval.

This provides lenders with an added layer of security, assuring them that payments will be made even if you face financial difficulties.

Loan Term Considerations

Opting for a shorter loan term can be advantageous in the case of a new job. While longer terms might offer lower monthly payments, they could be less appealing to lenders due to the prolonged commitment.

A shorter loan term indicates your intent to pay off the loan promptly.

Building Your Credit Score

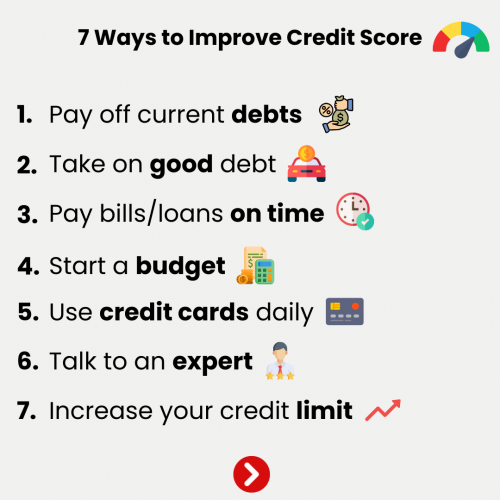

A strong credit score plays a pivotal role in loan approval. If you have limited credit history or a score that needs improvement, consider postponing your car purchase until you've had time to enhance your credit standing.

This demonstrates responsible financial behavior to lenders. Click here for some great credit-rebuilding tips.

Exploring Dealership Financing

Many dealerships offer financing options to buyers, including those with new jobs. Dealerships often have relationships with multiple lenders and can facilitate loan arrangements that cater to your circumstances.

This can save you time and effort while providing viable financing solutions.

You're Ready to Get Approved!

While securing a car loan with a new job may present challenges, it's far from impossible for Canadians. By showcasing your financial stability, providing proper documentation, considering a down payment, and exploring dealership financing options, you can increase your chances of obtaining the loan you need.

Remember, lenders are primarily concerned with your ability to make consistent payments, and by addressing their concerns proactively, you can confidently drive away with the vehicle you desire as you embrace your new job journey.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.