How to Rebuild Your Credit Score in Canada

How to Rebuild Your Credit Score in Canada

Posted on April 3, 2023

Canadians who want to rebuild their credit score have some unique challenges they must overcome. We are going to show you what steps you'll need to take to start rebuilding your credit score in Canada. It's a long process but anyone can do it. Here we go!

We All Rely On Credit in Canada

The average Canadian relies on credit to meet their basic needs, whether it is buying groceries or renting an apartment; without good credit, everything becomes more expensive.

As a result, household debt in Canada has never been higher, and that is even when you remove mortgages from the equation. This is why knowing how to rebuild credit score in Canada is important for so many of us.

Taking a Closer Look at Your Credit

Most Canadians were not taught finance in school and know next to nothing when it comes to credit scoring and credit reporting.

There are two credit reporting agencies in Canada, TransUnion and Equifax; you should sign up for their free credit reporting services and review both your score and reports.

The median credit score throughout Canada, all things being equal, is around 660; if your score is over that, then you are in good shape.

To access the most preferred car loan interest rates, you would need a credit score over 720, but even borrowers with a 600-credit score can get approved for a loan.

While looking over your credit report, you should look for any accounts that are either past due or in collections.

Past due accounts negatively impact your credit score and will remain on your report for up to seven years, so do everything within your power to bring those accounts up to date.

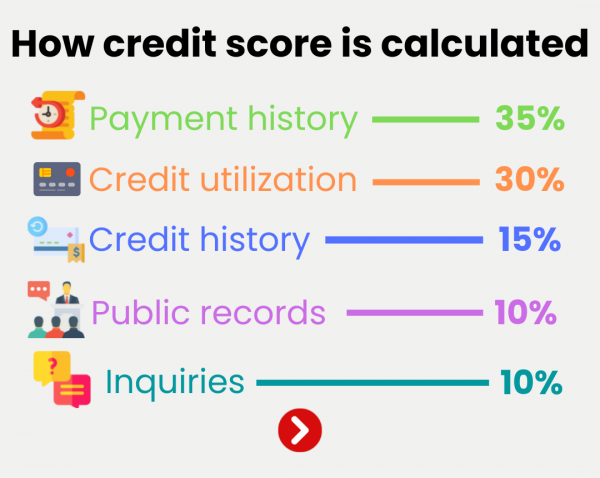

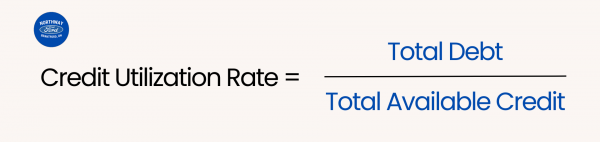

When all of your accounts are up to date, you should look at the total amount of debt you are carrying in relation to the amount of credit you have available. If your credit utilization rate is high, it will bring down your credit score.

Therefore, you should aim to keep your utilization rate below 30% to be in good shape.

If you have covered all of these basics and your score is still low, you might consider signing up for additional credit cards.

By having more accounts and access to credit, your credit score may drop slightly when you apply for new credit. Still, the score will bounce back once you start using the new facility.

How Long Does it Take to Increase Credit Score in Canada?

The answer to how long it takes to increase credit score depends a lot on your current score. The actionable answer is that you can begin rebuilding credit straight away and begin to see improvements typically within 3 months.

Continue improving your score steadily over time and you could go from subprime credit to good credit within 18-24 months. If you have bad credit, it might take longer. Again, it depends entirely on the score. The lower the score, the longer it will take to recover.

The main takeaway here is that no matter how low the score is right now, you can begin rebuilding it right away.

Ways to Rebuild Your Credit Score

Never miss a payment: To reduce overall costs, pay off the most expensive debt first if you can manage your borrowing without taking out a loan. Check the rates if you have a negative credit vehicle loan or other borrowing; however, that is typically the case with credit cards. Work your way down the list of debts, starting with the most expensive.

Resolve any bad debts: While the other suggestions can assist you in restoring your credit, holding onto poor debts will simply bring you back down.

Avoid applying for new credit accounts: Some applications result in a hard inquiry when you submit them, which lowers your rating. Hence, wait till your numbers are updated.

Use a credit builder card: These cards are made to assist you in reestablishing your credit. If you don't pay them off at the end of the month, they can cost more to service.

For making frequent purchases like gas or groceries, think about using a credit builder card, but make sure to pay it off each month. Your score will undoubtedly improve as a result.

Report your rent payments: Some landlords will mark your rent payments on your credit report, while others won't. If you rent an apartment, we advise you to urge your landlord to report your timely payments to one of the credit bureaus so you can start to reap some rewards.

Contact the Landlord Credit Bureau if your landlord doesn't mark payments; they might be able to help.

Get your phone contract payments reported: If your current phone contract is about to expire, make sure your new one will inform the credit bureaus of your payments. Not all providers offer this, and it does require signing a contract rather than choosing a more affordable provider, but if you're working to improve your credit, it can be worth the added cost.

Choose a contract with a mobile operator that offers a decent deal after doing some research on which ones report payments. Your credit score will rise more quickly the more favourable information you have on your credit report.

Make a household budget: Knowing where all of your money goes is a surefire way to remain on top of everything. Setting up a budget is the simplest approach to accomplish that. We advise all of our clients to do this in order to properly comprehend what is coming in and what is leaving.

Employ a spreadsheet, an app, or pen and paper. Whichever method you choose, be sure to establish an exact budget and maintain it.

You'll always be aware of your financial situation in this way.

Emphasize conserving money before paying off other kinds of debt or making any payments that were missed. After you are current, you can prioritize expensive debt first once more to reduce interest costs.

Keep previous credit card accounts active: When your credit score reaches the desired level, you can close any inactive accounts to keep your life organized. But, keeping card accounts open but inactive when you're rebuilding means the credit limits will positively affect your credit utilization.

If necessary, shred the cards or otherwise dispose of them. Simply keep your accounts active while you rebuild. When you're ready, you can choose to close the accounts.

Employ secured loans: Secured loans are beneficial for people with poor credit and can help you establish a payment history and credit score. Utilize the loan as a consolidation loan to pay off all of your other debts. Your credit score will eventually rise if you have a solid payment history by consistently making your payments on time.

After just a few months, a secured loan could start to raise your credit score when used in conjunction with a credit card and landlord alerts.

Hopefully you now have a better understanding of how to rebuild credit score after reading this article to the conclusion. Do not hesitate to get in touch with us if you have any more inquiries!