How to Get a Car Loan as an Independant Contractor in Canada

How to Get a Car Loan as an Independant Contractor in Canada

Posted on February 5, 2024

You cannot beat being your own boss. If you can manage the extra responsibility and are a self-starter, being self-employed is an amazing way to earn a living.

There are complications though when it comes to auto loans as a contract worker. especially when it comes to accessing credit in Guelph. Even though contracting has been around for decades, mainstream lenders still have trouble with it.

If you have tried to apply for an independent contractor car loan in the past decade or so, you’ll know exactly what we mean!

Fortunately, things are changing.

More lenders than ever are waking up to the fact the world is changing and the world of work has already changed almost beyond recognition. Let's dive in.

Proving Income as an Independent Contractor

The main challenge you have as a contractor is proving your income. You may also have issues with a sporadic income but it’s usually proving your worth that’s the issue.

You can do that in a couple of ways:

- Tax Return Copies: Your tax returns are an excellent method of proving your income. If you can provide 2-3 years of tax returns in support of your car loan application, you’ll find it much easier to get a loan.

- Bank Statement Copies: Not all lenders will require bank statements but preparing two years’ worth of them just in case is a good precaution. They can show your income and outgoings as well as support the affordability check.

Depending on the lender, your type of contracting and how you invoice or bill, you may need supplemental evidence. That’s something the lender will discuss with you at the time.

One thing to know as an independent contractor. Watch the deductions.

Contractor Deductions & Car Loans

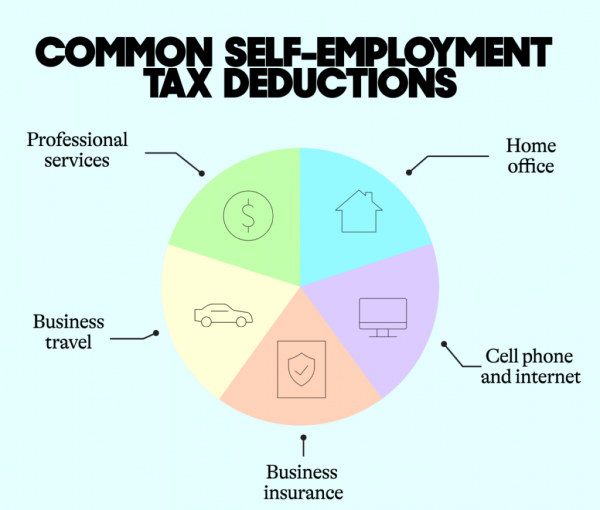

As a contractor you are legally entitled to make deductions for any costs you incur that are related to your business. As we all know, that has definite advantages in terms of offsetting tax liabilities.

However, if you’re planning to apply for credit anytime soon, you need to be careful what deductions you make and for how much.

It’s a juggling act. Balancing the tax efficiencies offered by deductions against the need to be seen to be earning a significant enough amount of money to qualify for an auto loan.

That is something you, or your accountant are going have to work out in advance of applying for any kind of car loan or any significant form of finance. The earlier in advance you do it, the better your picture will look when it comes time to apply for any kind of credit.

More lenders than ever are willing to work with contractors, freelancers, gig workers and other alternative types of employment. They realize that the old way of working is not the only way of working.

We work with those kinds of lenders. Those who see how the world really is and how people really work. When you’re ready to take on a car loan in Guelph, we can help.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval