Low Interest Car Loans in Ontario: How to Land a Great Deal

Low Interest Car Loans in Ontario: How to Land a Great Deal

Posted on February 12, 2024

Buying a car is a significant investment, and one of the most important decisions you'll make is how to finance it. In Ontario, there are a variety of options for car loans, but finding a low interest car is essential to getting the best deal possible.

Here are some tips on how to find a low interest car loan in Ontario.

1. Check Your Credit Score

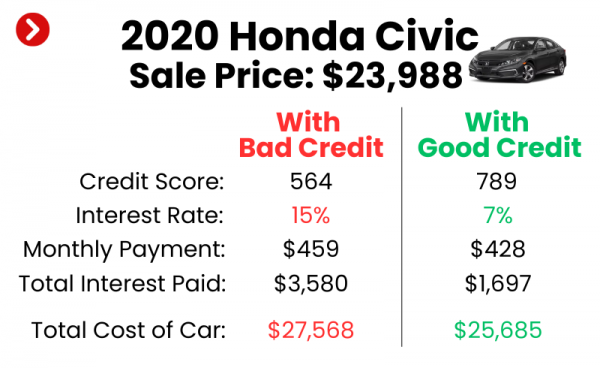

One of the most significant factors that determine the interest rate you'll receive is your credit score. Lenders use your credit score to assess your creditworthiness, and a higher score typically results in a lower interest rate.

Before applying for a car loan, check your credit score to ensure it's accurate and to see if there are any areas you can improve. Not sure how to check your credit score? Click here.

2. Shop Around for the Best Rate

Don't just accept the first car loan offer you receive. Shop around and compare rates from multiple lenders. You can do this by visiting banks, credit unions, or online lenders.

By comparing rates, you'll be able to see which lenders offer the best deals and potentially save thousands of dollars in interest over the life of your low interest car loan.

3. Negotiate With the Dealer

If you're buying a car from a dealership, don't be afraid to negotiate the interest rate. Dealerships often work with multiple lenders and can offer you a competitive interest rate to secure your business.

Additionally, they may offer special financing promotions or incentives that can save you even more money.

4. Choose a Shorter Loan Term

While a longer loan term may result in lower monthly payments, it also means you'll be paying more in interest over the life of the loan. Consider choosing a shorter loan term, such as three or four years, to save money in the long run.

5. Make a Down Payment

Making a down payment on your car can help lower your interest rate. Lenders view a down payment as a sign of financial responsibility and will often offer a lower interest rate as a result.

Additionally, a down payment can reduce the amount you need to borrow, which also lowers your overall interest payments.

6. Refinance Your Current Car Loan

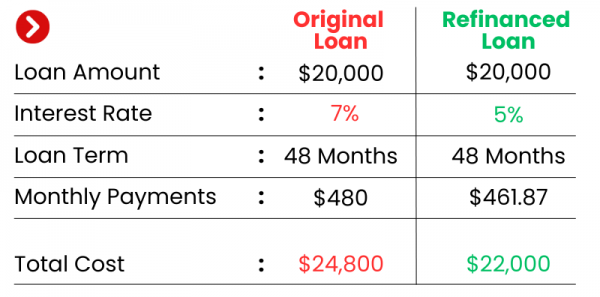

If you've already taken out a car loan with a high interest rate, consider refinancing. Refinancing allows you to pay off your existing loan with a new low interest car loan.

This can save you a significant amount of money in interest over the life of the loan.

If you're ready for a low interest car loan, we'd love to help with that! simply fill in the form below to get started.

Ontario Car Loan Pre-Approval