Negative Equity on Car Loans: Everything You Need to Know

Negative Equity on Car Loans: Everything You Need to Know

Posted on January 28, 2024

What is negative equity? Is it the same as being upside down? How does it impact auto loans and can you avoid it? These are all questions fielded by our auto loan team this year alone so we thought the subject would make an excellent blog post.

Negative equity is most often used with reference to mortgages but it can factor in to auto loans too.

Equity is the value of the asset you buy with your loan. If the asset is worth more than the loan, that’s positive equity. If it’s worth less, that’s negative equity.

Negative Equity and Car Loans

The term negative equity is used when your car is worth less than the loan you used to buy it. It happens most often when buying new cars but can often if you buy used with a modest down payment.

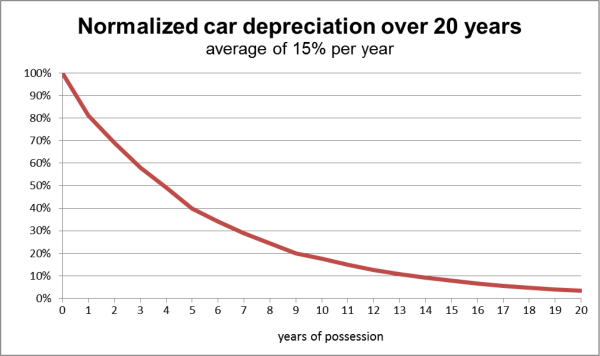

For example, you buy a new car for $45,000 and used a $35,000 auto loan to pay for it. The car depreciates by up to 30% in the first year, lowering its value to around $31,000.

The outstanding amount of the loan is more than the car is actually worth. Hence, negative equity on your car.

Front Loading and Negative Equity

If you add in front loading, you stand a higher chance of negative equity on a car in the early stages of any auto loan.

Front loading is where you pay a higher proportion of loan interest to principal in the first year or two of the loan. It then slowly evens out over the term of the loan so everything is settled in the end.

Front loading means you are paying relatively little of the principal for the first year, which increases the chances of negative equity.

Can you Avoid Negative Equity on a Car?

You can avoid it to a degree either by buying a used car or by using a larger down payment.

New cars depreciate the most in the first year and slowly evens out between years 1 and 5. Buying used means the largest chunk of depreciation has already happened so you stand less chance of negative equity.

A larger down payment also lowers the chance as you’re paying more of the value up front and not using the loan. The loan amount is lower, so your risk is lower too.

Negative Equity is Not a Bad Thing

Negative equity is not a bad thing in auto loans. It is only something to consider if you have to sell the car quickly or want to refinance within the first year or two of an auto loan.

Otherwise, it’s just a part of how loans work and things will even themselves out over time. The more you pay off, the less the negative equity. The longer you pay the loan, the less front loading there is, so you’re paying off more of the principal amount.

If you can manage a good down payment, you can avoid negative equity. If you buy used or keep your car for longer than a couple of years, negative equity has zero impact. So, while the term isn’t exactly pleasant, its effect is usually negligible!

When you’re ready for a car loan, get in touch with the Brantford auto loan experts at Northway Ford for great deals on auto finance.