Student Car Loans: Secure Affordable Financing In Ontario

Student Car Loans: Secure Affordable Financing In Ontario

Posted on March 20, 2024

Having a student car loan car might be necessary for the travel to college. You might have to think about getting a car loan if you don't have the money to buy one altogether. Today, we're talking about it. For people who are financing a car loan while still in school, our auto lending experts offers choices.

Here are some important facts about vehicle loans for students.

Save For The Down Payment

Down payments have two functions. These satisfy lenders and lower the amount you need to borrow. Saving as much money as you can may take some time, but it may mean the difference between being able to purchase a certain car or being approved for a student car loan.

As a sign of commitment, down payments are preferred by auto lending firms. Due to their lower default risk, lenders generally favour borrowers who are putting their own money on the line. This may determine whether you are accepted or not.

Have a Source of Income

To qualify for a car loan as a student, you’ll need a source of income to pay for it. For the lucky few, that could mean an income from parents or another source.

The bulk of us interpret this as finding employment. Working is not a significant concern because it is a common aspect of college life, but it may result in less time for studying or enjoying college.

The truth is that you won't be eligible for the loan if your salary is insufficient to cover the required monthly installments.

Build Your Credit Score

As a young person, you won’t have a high credit score as you won’t have been able to access credit. That needs to change.

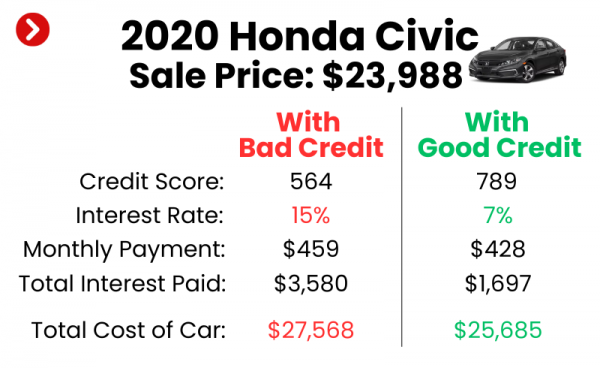

Even while you can receive an auto loan with bad credit, good credit offers far better rates. Use a credit card, a mobile plan that tracks your payments, and make sure you always make your payments on time.

Do everything you can to establish credit without spending any money.

Use a Co-signer or Co-Borrower

You can utilize a cosigner to guarantee the loan or a co-borrower to join you in the loan if you urgently need a car loan as a student.

A cosigner, who does not own the vehicle, guarantees your loan. If you default for whatever reason, they promise to pay back the money.

You co-borrow the money with someone who also partially owns the car. It converts your auto loan into a shared loan, transferring to them both legal ownership of the vehicle and responsibility for debt repayment.

As long as you know someone with high credit who is willing to cooperate with you, either can help someone with low credit qualify for a car loan.

Set Your Budget

We always advise establishing a budget before to car shopping. Have you ever heard of "champagne flavour on lemonade money"? The same may be said of autos.

The majority of us frequently desire autos that are out of our price range. Prior planning should prevent you from falling in love with items that are out of your price range. The should...

To get at a useful number, your budget should take into account your down payment or trade-in as well as the amount you could borrow. To finish up, use a car loan calculator.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Pre-approval For a Car Loan as a Student

An auto loan preapproval is a litmus test to determine whether you would be eligible to borrow the amount you wish to with your current credit score.

It won't affect your credit score and isn't a loan offer. It's a test run to determine if you might be eligible without having to submit a loan application. Reduce your loan amount or increase your down payment, whichever you feel most comfortable doing, if you are not eligible to borrow the whole amount you wish to.

Find a Good Cheap Car

If you're a college student, try to resist the urge to purchase anything pricey. If you're a rookie driver, you'll dent the car, and crime can be a problem if you live in a student neighbourhood or on campus.

You wouldn't want your car to be affected by any of that. To deter thieves while providing a safe, dependable drive, we advise purchasing a top quality, regular car!

Car Loan Pre-Approval