Subprime Car Loans in Canada: How to Get Approved

Subprime Car Loans in Canada: How to Get Approved

Posted on April 10, 2024

Picture this: cruising down a sun-drenched highway, wind in your hair, and the open road ahead.

The allure of owning a car is undeniable, providing freedom, convenience, and a sense of adventure.

However, in Canada, as enticing as car ownership may be, there's a bumpier side to the road called subprime car loans.

The Pitfalls of Subprime Car Loans

Life sometimes throws us curveballs, and financial hiccups can happen to anyone. That's where subprime car loans come into play.

These loans are designed to help individuals with less-than-perfect credit scores purchase a vehicle.

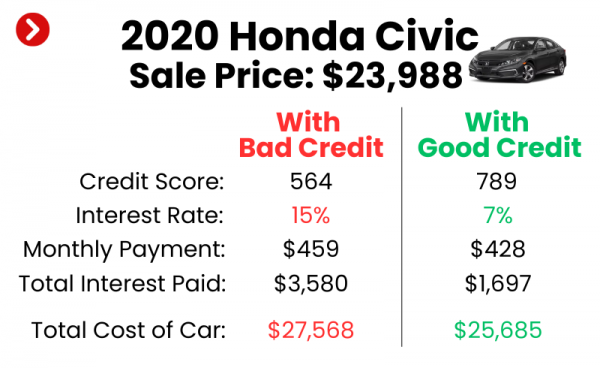

However, caution is advised. Subprime car loans often come with higher interest rates, increased down payments, and shorter repayment terms.

It's like driving with a blindfold on a risky proposition that can lead to a financial crash if not handled with care.

The Canadian Landscape

In Canada, the subprime car loan market has gained momentum in recent years. Canadian lenders, keen on expanding their portfolios, have tapped into this niche market to cater to those who have had credit challenges.

While the availability of these loans can be a lifeline for some, it's crucial to understand the potential pitfalls and navigate this terrain with a steady hand on the wheel.

Buckle Up for Success

Know Your Credit Ccore: Start by understanding your creditworthiness. Obtain a copy of your credit report and review it carefully.

Identify any errors and take steps to rectify them. Being informed puts you in the driver's seat.

Set Realistic Expectations: As tempting as that shiny sports car may be, assess your financial situation realistically.

Set a budget that factors in not only the monthly payments but also insurance, maintenance costs, and unforeseen expenses.

Research, Research, Research: Shopping around for the best loan terms is essential. Don't settle for the first offer that comes your way.

Reach out to various lenders, compare interest rates, and repayment terms, and consider the total cost of the loan over its lifetime.

Negotiate Wisely: Negotiation is key. Approach the loan application process armed with knowledge and leverage.

Understand the current interest rates, market conditions, and your own financial standing. Negotiate for better terms and lower interest rates whenever possible.

Build an emergency fund: While it may be tempting to dive headfirst into a new set of wheels, it's important to establish a safety net.

Save up an emergency fund to protect yourself in case of unexpected financial hardships. A flat tire or unexpected medical bill should not derail your financial stability.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.