Ontario Car Loans: Get Behind The Wheel in Under 24 Hours

In today's fast-paced world, owning a reliable set of wheels is no longer a luxury but a necessity. Having a car can truly enhance your daily life.

However, for many Canadians, the path to car ownership can be obscured by a dense fog of financial complexities.

Fear not, fellow motorists, for I am here to guide you through the intricacies of Ontario car loans with my trusty pen and a dash of wit.

The Quest for the Perfect Ride

Picture this: you've fallen in love with a sleek, shiny automobile, perfectly suited to your needs and desires.

You can already feel the wind in your hair as you zip down the highway, but there's just one obstacle in your way – financing.

Ontario car loans are the key to transforming your automotive dreams into a tangible reality.

Before you hit the open road, buckle up and prepare to dive headfirst into the world of auto financing.

The Mechanics of Ontario Car Loans

Ontario car loans, much like the intricate inner workings of a car engine, may seem daunting at first, but we'll break it down.

At its core, an auto loan is a financial agreement between you, the borrower, and a lender.

The lender provides you with the funds necessary to purchase a vehicle, and you repay the loan over time, typically in monthly installments.

Interest Rates: The Fuel to Your Loan's Engine

Ah, interest rates, the fuel that propels your loan's engine forward.

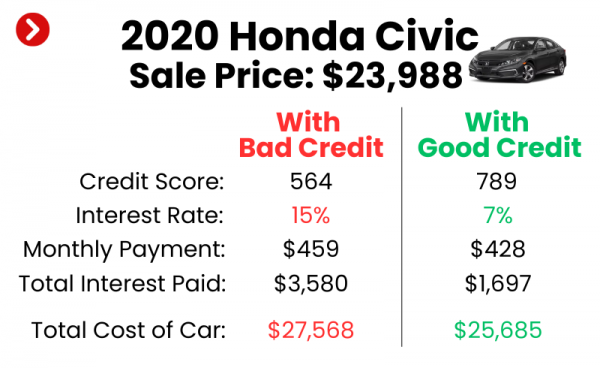

When it comes to auto financing, it's crucial to secure the best interest rate possible.

A lower interest rate means paying less over the course of your loan, saving you precious loonies and toonies in the long run.

So, don't be shy—shop around, compare rates, and negotiate like a seasoned race car driver.

Down Payments: Clearing the Initial Hurdle

Before you embark on your automotive adventure, you'll encounter the hurdle known as the down payment.

The down payment is the initial amount you pay out of pocket when purchasing a car.

This upfront investment reduces the loan amount, which, in turn, can help you secure a better interest rate. Think of it as a pit stop before you rev up your financial engine.

Credit Scores: The Roadworthy Indicator

Your credit score is the compass that helps lenders assess your creditworthiness.

Like a well-maintained car, a good credit score opens doors to better loan terms and interest rates.

Keep your credit history in good shape by paying bills on time, reducing debt, and resisting the temptation of unnecessary credit applications.

A strong credit score is the vehicle that carries you toward better financing options.

Term Length: Finding the Right Lane

Choosing the right term length for your loan is akin to selecting the optimal lane on a bustling highway.

Longer terms often result in lower monthly payments, but they can also mean paying more in interest over time.

Conversely, shorter terms may require higher monthly payments, but they can help you save on interest. Find the balance that best suits your financial roadmap.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.